Betting On Bakken with Micro-Caps

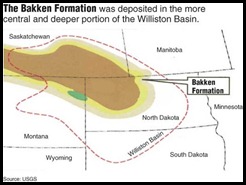

By now, most investors have at least heard of the Bakken Shale, a massive formation that reaches from Canada down to North Dakota and Montana. Simply put, the Bakken Shale is the largest contiguous oil deposit in the continental U.S. and it has created a major oil boom in North Dakota, the state where most of the Bakken’s lush reserves lie.

By now, most investors have at least heard of the Bakken Shale, a massive formation that reaches from Canada down to North Dakota and Montana. Simply put, the Bakken Shale is the largest contiguous oil deposit in the continental U.S. and it has created a major oil boom in North Dakota, the state where most of the Bakken’s lush reserves lie.

The Bakken oil boom has helped North Dakota achieve one of the lowest unemployment rates in the U.S. Beyond that superlative, North Dakota’s monthly oil production statistics are on a seemingly never-ending uptrend. Nearly every batch of monthly output numbers is better than the previous month’s and that has helped North Dakota recently become the third-largest oil-producing state behind Texas and Alaska. Based on current production levels, it’s only a matter of time before North Dakota steals the number two spot from Alaska.

Of course, the Bakken has become a legitimate investment theme and plenty of large oil and gas companies such as Continental Resources (NYSE: CLR) and Hess (NYSE: HES) have significant footprints in the region. However, the Bakken Shale can only move the needle so much for large-cap companies. Translation: Micro-caps are not only a valid way of betting on the Bakken Shale, but perhaps the best way of doing so.

Here are three micro-cap Bakken plays to consider:

Triangle Petroleum (AMEX: TPLM):

One caveat with regards to Colorado-based Triangle Petroleum: The Company’s market value of about $313 million puts it just outside of the defined micro-cap range. So we can call Triangle Petroleum either a large micro-cap or a very small small-cap. As of May 2011, the company owned approximately 72,000 net acres in the Williston Basin, but investors have only recently begun responding to the stock, which is up almost 16% year-to-date.

While it is accurate to consider Triangle an early stage development company, it also must be noted that the company has approximately $110 million in cash and no debt. That means Triangle’s cash position is equivalent to more than a third of its market value. And that means the company is probably undervalued on a cash basis alone.

Analyst David White notes the Company’s Bakken acreage might be worth $11,000 per acre. That would mean Triangle’s acreage is worth north of $800 million, or more than double the company’s current market value. Again, that means the shares are likely undervalued.

U.S. Energy Corp. (Nasdaq: USEG):

While Triangle Petroleum is just beyond the micro-cap area, Wyoming-based U.S. Energy is firmly within that designation with a market cap of $83 million. The company is mainly focused on Bakken and Eagle Ford, another pivotal shale play in South Texas. At the end of 2011, U.S. Energy had over 2.6 million barrels of oil equivalent reserves, the vast majority of which was oil. U.S. Energy has almost 19,000 Bakken acres in Montana and was cash flow positive in the fourth quarter.

American Eagle Energy (OTCBB: AMZG):

Easily the most speculative name on this list, American Eagle Energy recently provided a bullish update of the operations of its Spyglass Bakken and Three Forks projects in Divide County, North Dakota.

“We are excited to have kicked off our 2012 operated development program with the drilling of the Christianson well. We have a frac date for late March that will get the well producing early in the second quarter,” stated Brad Colby, American Eagle’s President, in a news release “Further, the non-operated wells in our portfolio have also contributed materially to the development of the play and have allowed us to be confident with our decision to continue to increase our acreage position in the play.”

The bullish Bakken outlook may be the tonic American Eagle needs to become consistently profitable, something that has eluded the company in the past year.

Bottom Line: Bet on the Bakken with micro-caps

Posted by Dr. Micro

Guest Analyst