Valuation “Arbitrage,” Private Companies vs. Public Companies

A Pre IPO investing strategy that has delivered 371%, 547%, 1,216% and YES… even 11,589% gains to early- stage, private investors…! These gains have been on the OTC Markets, the NYSE, NASDAQ and the Toronto Stock Exchange.

Here’s a basic primer: The textbook definition of arbitrage is the capture of “riskless” profit by simultaneously executing opposing transactions on different markets. For example, if a given stock is selling at $100 per share on one stock exchange and $98.50 on another, a trader could simultaneously purchase it for $98.50 and sell it for $100, thus earning a riskless profit through arbitrage.

The key point we are trying to make is that… it seems to be a given, that there is an inherent profit opportunity in a true arbitrage… in this case, a stock arbitrage.

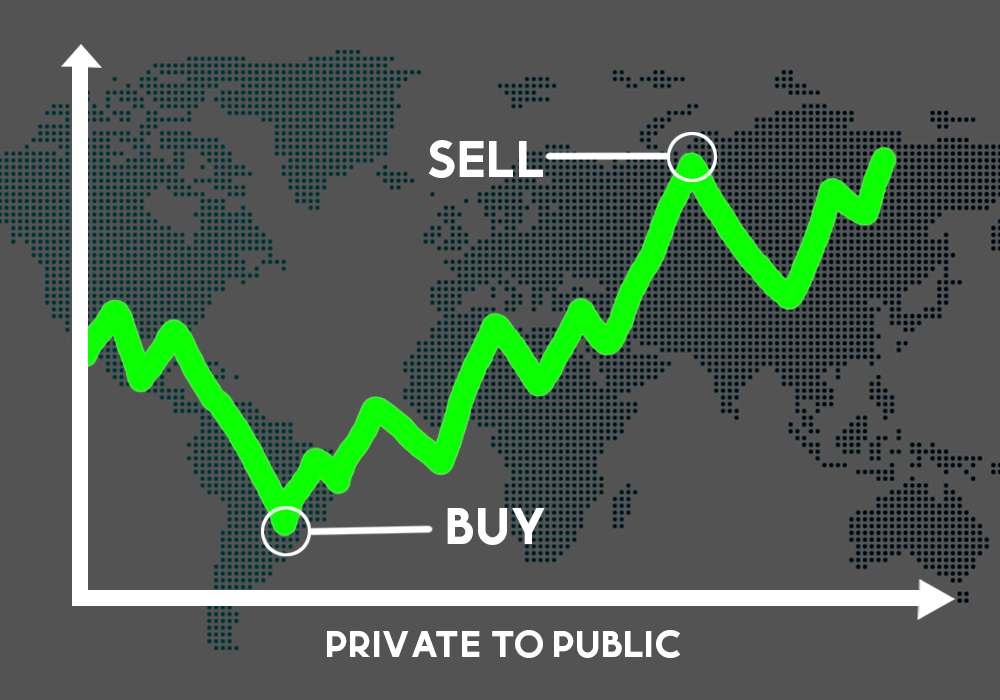

How does this apply to Pre IPO investing…?

Invest in a private company before it IPO’s, or completes an initial public offering, if you’re looking for outsized returns. Here’s why…!

Public Company Valuations are Usually Higher than those for Private Companies

Private companies typically suffer from much lower valuations than do their public counterparts. This is because in addition to the same potential risks that public companies face, private company investments entail several significant drawbacks:

• Because there is no public market for shares in a private company, an investor who wishes to sell his or her share position must find a specific individual or group that may legally purchase the shares, and then do considerable legal paperwork to effectuate the sale.

• Because information about the business results and likely future fortunes of a private company can be very elusive, as they have no disclosure requirements and do not make filings with the SEC / U.S. Securities and Exchange Commission. This makes it difficult to correctly assess the likely fair value of private company shares.

Public Company Valuations Can Be Driven By Market Forces

Public companies are typically valued at a multiple of revenues or earnings (EPS or earnings per share), and expected future revenues and earnings, but are “penalized” for risk. With public companies, the company-specific risks are the ones that affect valuation the most – those with high risk of product obsolescence, a large pending lawsuit, or myriad other risks – will typically get a smaller multiple of revenues or earnings in their share price than those that embody fewer risks.

Also, companies that are positioned in a dynamic and fast growing business sector like cannabis and medical marijuana, will carry a premium valuation; here are some market drivers to consider:

• Cannabis industry is estimated to drive $40 billion in economic output by 2021

• Compound Annual Growth Rate (CAGR) estimated at 30.7% thru 2023

• Nearly two-thirds of Americans think marijuana use should be legal

• Marijuana industry expected to create 414,000 jobs & $4 billion in tax receipts in 2 years

• 93% of Americans favor legalization for medical marijuana

Source: Archview Group 1/2018, Quinnipiac University Poll 4/2018 and Gallup Poll 10/2018

Therefore, public company valuations can be and typically are two to five and sometimes, ten to twenty-five times higher for public companies than for private ones, all other things being equal.

We believe that this, perhaps more than any other single factor, makes an investment in Pre IPO Private Cannabis Offerings very attractive to would-be investors. Industry professionals refer to this investment strategy as a “private-to-public valuation arbitrage.”

To help convey how this might work, we have selected five public companies that are in some way directly involved in the cannabis or marijuana sectors. A comparison of these five companies’ per-share valuations during their last pre-public financing round vs. their share price now illustrates the private-to-public valuation arbitrage which we believe is the key factor when considering Pre IPO Offerings.

| Cannabis-related Public Companies Illustrating Private-to-Public Valuation Arbitrage | |||||

| Company Name | Stock Symbol | Total Return from Final Pvt. Placement to Today* | Final Pvt. Placement Share Price | Current Price* | 52 Wk Range |

| Aurora Cannabis | ACB (TSE) | 1,216.5% | C$0.85 | C$11.19 | C$5.29-16.24 |

| Generation Alpha | GNAL (OTCQB) | -67.0% | $0.50 | $0.1650 | $0.145-1.05 |

| GrowGeneration | GRWG (OTCQX) | 371.4% | $0.70 | $3.30 | $2.05-5.10 |

| Tilray | TLRY (NasdaqGS) | 547.2% | $6.78 | $43.88 | $20.10-300.00 |

| Canopy Growth | CGC (NYSE) | 11,589.5% | $0.38 | $44.42 | $24.21-59.25 |

*Current closing prices as of May 24, 2019

As can be seen from four out of five examples, the difference between private company valuations and public company valuations can be quite pronounced, and very beneficial to those investors who are in a position to participate in the most promising private company investments in advance of a planned IPO.

Even Generation Alpha (GNAL) which is showing a current 67% loss, offered investors an opportunity for 110% gains when it hit $1.05 per share.

However, we must also stress that we selected these particular cannabis companies after-the-fact, meaning those that failed in their IPO efforts would not even show up in our universe. Clearly, not all investments will exhibit returns similar to those listed above, and the ones in which you participate may not produce any returns at all. That’s why this is called investing… and not saving…!

Traditional investment guidelines still apply – so do your homework.

Investments in Pre-IPO companies are speculative, illiquid, carry a high degree of risk, including total loss of your investment and companies may never reach public status.

Disclaimer and Disclosures: Green Leaf Investing, Green Leaf or GLI is a financial publisher and not a FINRA broker/dealer or investment adviser. Green Leaf is not registered with the SEC / U.S. Securities and Exchange Commission or any state securities regulatory agency. Readers, subscribers and web site visitors are responsible for individual investment decisions. All information contained in our newsletters or on our web site and in our blogs should be independently verified with the featured companies and readers should always conduct their own research and due diligence and engage professional investment advisers as they deem appropriate before making investment decisions. Please review our Terms and Conditions of Use, including without limitation all disclaimers of warranties and limitations on liability contained therein. Your use of this web site and any information contained herein or in our newsletters and blogs constitutes your agreement of same. Officers, employees and affiliates may hold positions in the featured securities discussed in our newsletters or on our web site and blogs and may buy or sell said securities at any time without further notice. GLI and/or affiliates may receive cash and/or equity compensation from featured companies for corporate communications services. You should be aware of this potential conflict of interest. We believe the information contained herein and in our publications to be reliable but cannot guarantee its accuracy; therefore, all information is provided as is without warranty of any kind. Past results are not necessarily indicative of future performance.

Posted by:

Research and Editorial Staff

GreenLeafInvesting.org © 2019 Green Leaf Investing, All Rights Reserved