What To Do When the Stock Market Crashes

The first thing…don’t automatically lock in your loses by selling good stocks.

Your portfolio companies didn’t suffer a downgraded credit rating so now is not the time to panic and go to cash automatically. You may certainly want to re-evaluate your thinking and ask yourself, “Why did I buy these stocks?” and “Are they still good investments?” Below are seven key considerations you’ll want to review when the market goes south.

Seven Things to do When the Stock Market Crashes

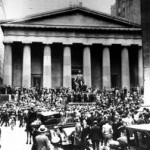

It’s every investor’s worst nightmare. You’ve been patting yourself on the back, watching your stocks climb higher over the past few months and perhaps assumed the upward direction is somewhat of a foregone conclusion.

Then you wake up one morning and watch as the market opens down several percentage points… the economic news is unexpectedly grim. You watch as the market plummets with lightning speed.

Unless you are some old battle scared veteran trader, your mind probably begins to race a little. What to do? Should you sell out before things get worse?

Do you hold on and hope things get better? Do you use this opportunity to load up on some issues you’ve had your eye on?

If you even considered the latter possibility, you’re smarter than the average bear.

A lesson from two of the best

Nevertheless, some of the most successful investors in history say the best thing to do about fluctuations in the market is to ignore them and focus on the prices and prospects of the companies you own or want to own.

Peter Lynch, the former manager of Fidelity Magellan fund, is widely considered to be one of the best investors of all time. His advice in One Up on Wall Street was to ignore the market and focus on companies.

Warren Buffett, as quoted by Lynch, voiced a similar sentiment, saying that “The market exists only as a reference to see if anyone is offering to do something foolish.”

Even in a hyper-inflated market, there are always good buys being underpriced and overlooked, especially for the individual investor who doesn’t have the size constraints of the big funds and institutional investors. The smaller issues may be just the thing you need in your portfolio.

Even in a bargain basement market, there are always a few stocks whose price has been inflated by hype and unfounded expectations.

Look at companies…not markets

By looking at companies and not markets, you can get a handle on whether an individual issue is a bargain, regardless of where the market as a whole stands.

Here are seven critical things to consider:

1) What’s the P/E ratio? If you’re paying 75 times the company’s earnings, you’d better have a very good reason. On the other hand, a P/E of 5 might well be the first sign of a bargain. Be aware that stocks in different industries have different expected growth rates and therefore different average P/E’s.

The PEG ratio, which compares a stock’s P/E to its growth rate, helps compare stocks across industries. While you’re looking at these ratios, compare the current P/E of the stock to its historical range and to the P/E’s of other stocks in the same industry.

2) How is the debt load? Stocks with debt/equity ratios under .5 are well positioned to withstand temporary downturns. Research and understand interest coverage, quick ratio, and current ratios as well. These are all measures of a company’s ability to meet its obligations.

3) Take a look at free cash flow. Free cash flow is often a good sign of a healthy business. When a company has to spend a lot to make a little, its cash flow will be low and it will more easily flounder in the event of a downturn.

4) Look at the cash balance. Often overlooked, the cash balance can sometimes indicate a screaming bargain. If a stock is a bargain at $10 a share, it may be an extraordinary bargain if $4 of that $10 represents a cash-per-share balance. Of course, the company cannot always be depended upon to use that cash wisely, but it’s better to have too much cash than no cash and tons of debt.

5) Don’t forget about dividends. While the youngest, fastest-growing companies usually don’t pay dividends, a healthy dividend can turn a boring slow grower into a great buy, especially when large cap stocks are out of favor and you can afford to wait for the turnaround.

6) Don’t forget to read the news. Caught up in a great set of numbers, it’s easy to overlook the latest news on a company. But if the reason the price is so low is because the company just lost the customer that supplied 80% of its business, it’s probably not a bargain after all.

7) Make sure you understand the story. If you have no idea how your company makes money, you’ll have no idea why you’re buying it or when to sell it.

If you know that it deals in a simply understood business like used auto parts, you’ll know it’s likely to do well when the nation’s cars are getting old and the economy is so bad people can’t afford to buy new ones. When new car sales soar, you’ll know it might be time to consider selling.

Dig into the details of high-tech, nanotech, biotech and latest thing-tech. If you don’t understand these rapidly changing fields inside and out, how will you know if your company is really on to something, if it’s competitive or can stay competitive? Don’t simply assume that the best buys are in the cutting-edge fields. Often, that’s not the case.

In closing…look at these numbers periodically and not just when you are getting ready to buy a stock. They’ll help you decide when to buy and when to sell, regardless of what the market as a whole is doing.

A few words on market timing

While market-timing for most investors is usually a losing proposition, there are exceptions. Occasionally, it is so clear that the market is over or underpriced that you’ll have a golden opportunity.

When dot-coms with no profits are selling for outrageous P/E’s, take your money and run. When the entire market is so depressed that loads of perfectly good stocks are selling below book value, jump in and buy.

But most of the time, you won’t know for sure which way the market is heading and neither will anyone else. Plenty of gurus will claim to know, and you can look at their failed predictions from former years to see how reliable they are.

Your best bet?

Invest in the fundamentals and be patient. In the long run, you’re likely to wind up with a lot more money than day traders and market timers, even if your timing is terrible.

Research Staff

MicroCap MarketPlace